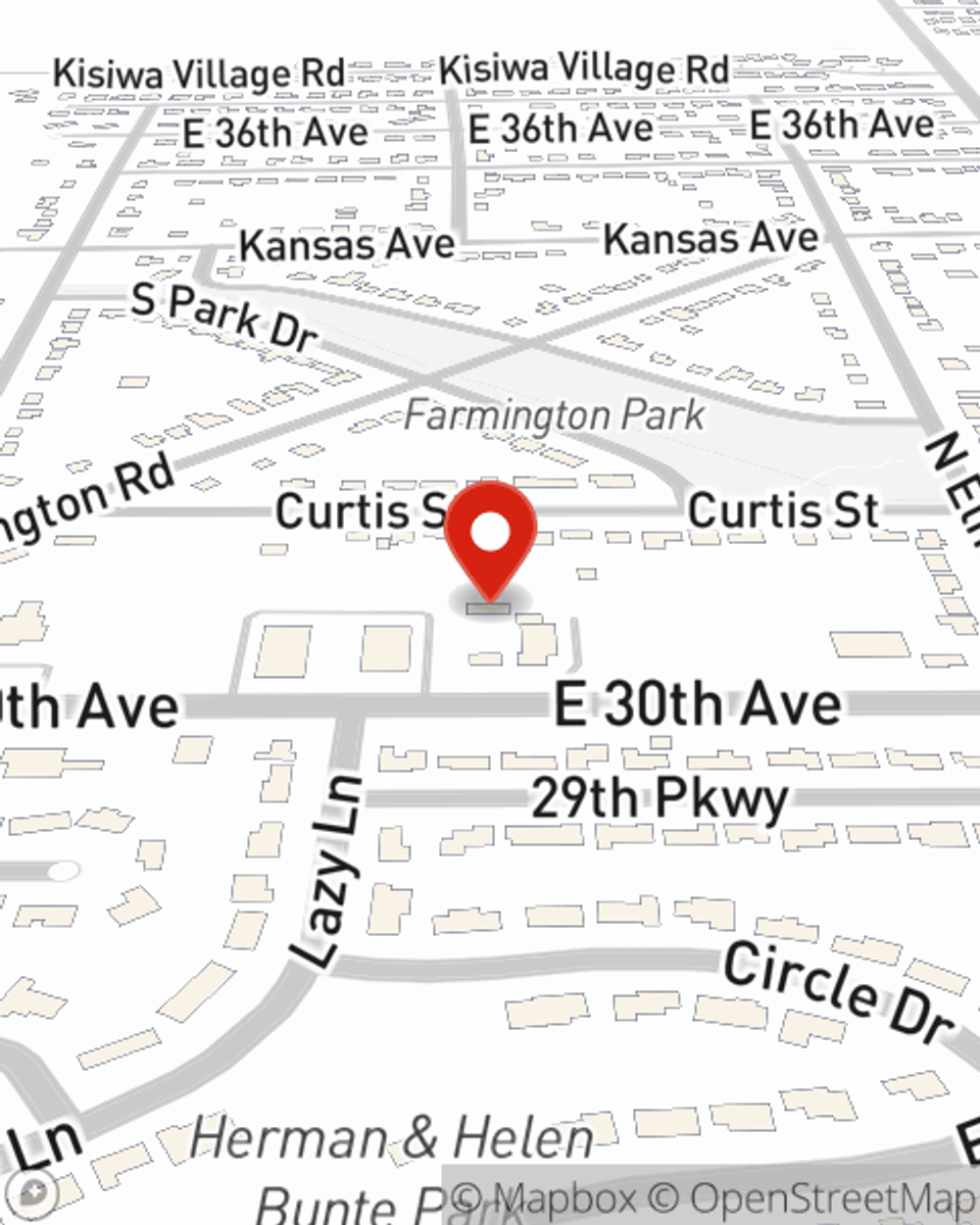

Business Insurance in and around Hutchinson

Calling all small business owners of Hutchinson!

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Problems happen, like an employee gets hurt on your property.

Calling all small business owners of Hutchinson!

Helping insure small businesses since 1935

Insurance Designed For Small Business

Protecting your business from these potential mishaps is as easy as choosing State Farm. With this small business insurance, agent Greg West can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Don’t let the unknown about your business keep you up at night! Contact State Farm agent Greg West today, and see the advantages of State Farm small business insurance.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Greg West

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.